Naval Ravikant Nails the Path to Financial Freedom in 12 Sentences Flat

“Act out of inspiration, not out of obligation.”

This instalment of Unfiltered is free for everyone. I send this email weekly. If you would also like to receive it, join the 86,000+ other smart people who absolutely love it today.

👉 If you enjoy reading this post, feel free to share it with friends! Or feel free to click the ❤️ button on this post so more people can discover it on Substack 🙏

We want to be wealthy.

Not for money but the freedom.

Naval Ravikant made waves in Silicon Valley as an investor and founder of the startup AngelList. His work has transcended business and into the realm of philosophy.

He’s regularly quoted as one of the greatest thinkers of this century.

In 12 sentences, he’ll completely reprogram your brain to think about money in new and exciting ways. Use the knowledge to access financial freedom sooner.

“Act out of inspiration, not out of obligation.”

Work is how we make money.

Yet so many people suck at their careers. Not because they are stupid or under-skilled. No. It’s because they work out of obligation to earn money instead of inspiration.

This hasn’t been my reality for 2.5 years.

I’m insanely driven but nobody tells me to be. Money isn’t the motivation. I listened to an interview today between Danny Miranda & David Senra from the Founders podcast.

David is a giant weirdo because he reads one book a week, turns it into a podcast, then publishes it and makes millions of dollars.

The way he makes money is weird. Yes, he gets paid from ads and member subscriptions. But what really makes him wealthy are the connections he gets because of his podcast. How?

These connections refer investment opportunities to him.

He gets to be an early investor in businesses that go on to make a lot of money.

Most of you reading this wouldn’t think money could be made that easily from a podcast – yet it can be. David wakes up out of inspiration to read.

When you listen to his podcast you can hear his love for reading books in his voice. The inspiration bleeds out of him. He can’t wait to do what he does.

I feel that way about this Substack. I cannot wait each week to write this letter to you with the aim of bringing you closer to ideas that create goosebumps.

I want you to feel chills all over your body. I search for those ideas my entire week.

Sometimes I hit the jackpot, other times I miss the mark.

But success or failure isn’t the point of this way of working. It’s driven by inspiration. It’s a form of automatic motivation that produces the best flow states of your life.

If you’re being told what to do at work, work after hours on a project that can replace your current career.

Inspiration makes more money than obligation to work ever will.

"Forget rich versus poor, white-collar versus blue. It's now leveraged versus un-leveraged."

Leverage is another huge topic Naval made mainstream.

About 3 years ago I had no idea what it was. Leverage is simply a mental model that says you get more results than the original effort you put in.

The goal is you want to do one task per day that compounds. When leverage multiplies your inputs, it makes your outputs look incredible. This is the secret to wealth according to Naval.

“It doesn’t take money to make money, it takes leverage to make money.”

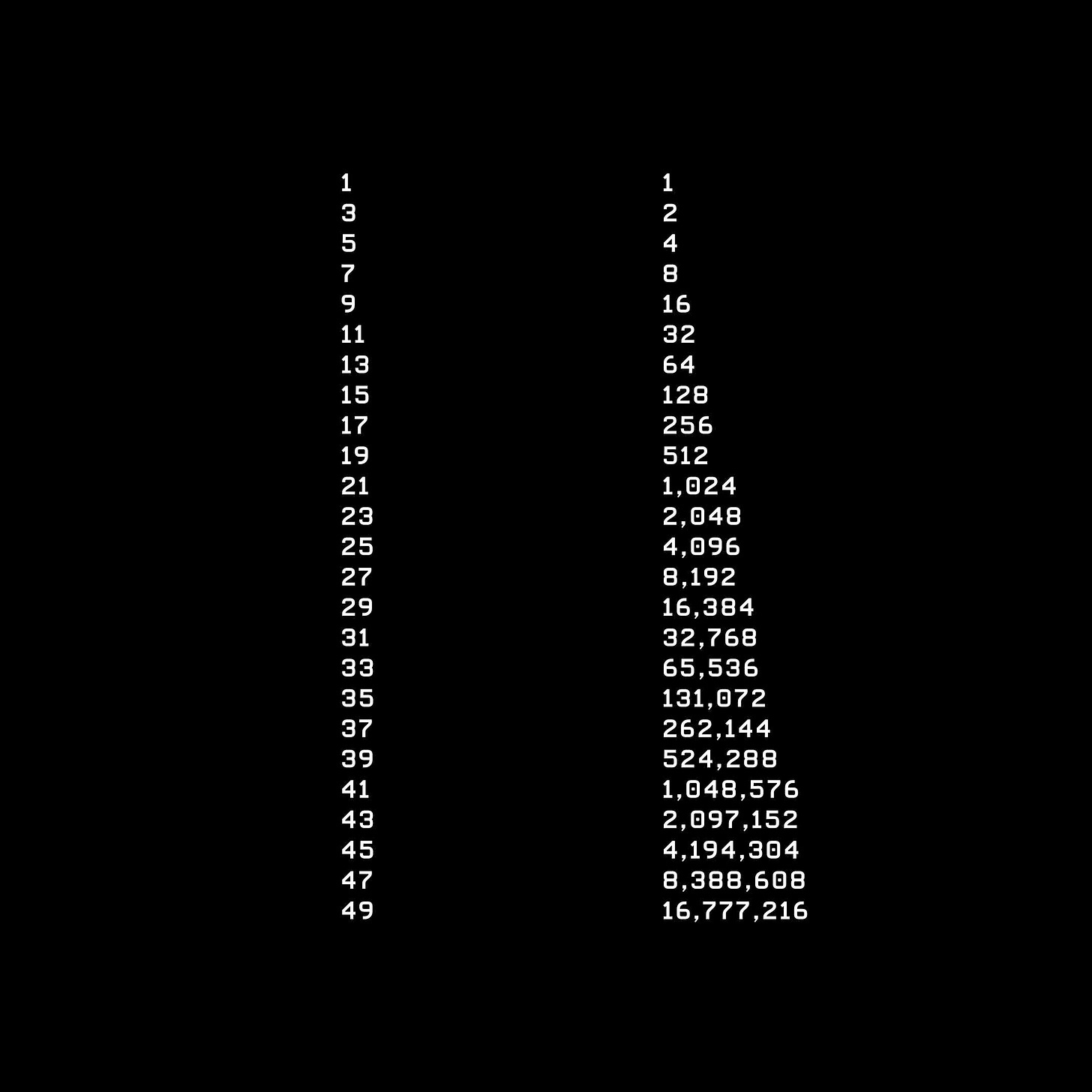

It helps to visualize leverage. In this illustration, the left side is labor and the right side is leverage.

Get to the right side as quick as you can if you want to beat inflation to reach financial freedom.

"There are almost 7B people on this planet. Someday, I hope, there will be almost 7B companies.”

What Naval hints at here is a change in how we work.

The employee model is plagued with problems. It causes people not to take ownership. And personal responsibility is one of the greatest predictors of success.

More people are becoming one-person businesses.

They’re charging for their value, not their time. They work when they’re needed and take time off when projects are completed. This is the future.

We’re all now entrepreneurs. So learn how to operate as a business.

Or just have multiple customers. One main one (known as a job), and a few small customers on the side that you freelance the same skills to.

“Smart money is just dumb money that’s been through a crash.”

Crashes humble people.

What a lot of people don’t realize is wealth is often built in recessions and bad economic times. Why?

It’s just easier.

During hard times weak minds give up or fall victim to the news cycle. So they sell all their assets or stop investing in their future.

But a small number of people do the opposite. They see that everything is on discount. They realize it’s easier to succeed when your competition is afraid or distracted.

It’s why many of the tech giants like Uber and Netflix were built during the 2008 financial crisis. Downtimes produce change, and change creates opportunity.

I’ve been dumb with money plenty of times in life.

In the 2008 crash, I nearly lost everything but survived. In the 2020 crash, and the recession that’s followed on and off for the last 2 years, I’ve behaved differently.

Fear doesn’t hold me back.

I become more aggressive as investor when everyone is fearful. And when markets are pumping to euphoric levels, like in 2021, I back right away.

This strategy can work for you as well. On that basis, now is one of the best times in history to be an investor and put money to work.

The next bull run will be spectacular.

“The best way to stay away from this constant love of money is to not upgrade your lifestyle as you make money."

I became wealthy because of this quote.

I’ve obsessively upgraded my income but tried to keep my expenses quite flat. This means that I have more and more money in surplus to invest in real assets like stocks. Those assets make money so I don’t always need to.

Avoid lifestyle creep.

Advertising tells you that you need all this extra junk to solve half-problems. You don’t. Spend less to become more free.

"I don’t care how rich you are.

I don’t care whether you’re a top Wall Street banker. If somebody has to tell you when to be at work, what to wear and how to behave, you’re not a free person.

You’re not actually rich."

This is a snarky quote.

It pisses off a lot of people. Often those with high salaries are mistakenly put in the category of wealthy. They may have money and be rich…

But they’re NOT wealthy.

They’re poor because they get told what to do and have their time management outsourced to a bunch of suits.

I don’t have hundreds of millions of dollars, but I don’t get told what to do anymore. I do what I want when I want. And my 7 month old daughter gets more of my time than my paid work does.

This reality is weird. It’s back the front compared with society.

This is what freedom looks like. Family over work. Freedom over money. Relaxation over obligation.

Move towards work where you call the shots and work to your own schedule. Most work isn’t time critical, therefore it can fit around your life, instead of the reverse.

"You want to be rich and anonymous, not poor and famous."

This is a quote I revisit daily.

Because of what I do online, I’ve accidentally put myself on the path to fame if I keep going and growing my audience at the same rate.

It’s why I’ve slowed down on social media.

I don’t want 1.5M email subscribers like Tim Ferriss because then everyone will know who I am – and I’m not special or gifted. I don’t want attention. I’m a quiet guy.

Naval taught me this is real wealth. Lots of money that buys time, so you don’t need to jump through hoops like a circus monkey … is the goal to aim for.

"Rich people get paid by the project and pay by the hour."

I recently ran a small coaching group.

Each person paid $10,000 to be part of it and there was one deliverable. I didn’t get paid by the hour, and if I did, I would have got paid probably 1/10 of that price.

I got paid to deliver an outcome. This way of thinking requires a mindset shift. Jobs have taught us to charge by the hour. But the problem you solve has a unique value which is likely higher than a by-the-hour business model.

Experiment with outcome-based work.

It’ll show you your true value and likely increase your income. The easiest problems to solve for others are the ones a job currently pays you to work on.

"If your income is coming from labor rather than assets, you’re being decimated by hidden inflation."

Bang! Smack! Pwahhhh!

That’s what this quote does to people when I share it with them. Inflation has become a hot topic since the 2020 bat virus. You’ve likely seen free stimmy checks handed out or record-high prices on the everyday goods you need to live.

Wage growth has been slow over the decades. The devaluing of government-issued currency, like the US dollar, is enormous. That’s a recipe for financial decimation.

There’s no path to financial freedom that doesn’t involve owning assets.

These are assets that appreciate over time and/or produce an income. Invest in these and you’ll slowly be required to work less over time until you hit financial freedom.

Labor = Dumb Money

Assets = Smart Money

Combine the two … or progress from the first to the second.

"If you don't own a piece of a business, you don't have a path towards financial freedom."

Another mind-bender for some of you.

Wealth is created through businesses. You either start a business or at the very least own part of someone else’s business through investing or stocks.

There’s no way around this one. Businesses generate cash that’s disconnected to hours worked aka the labor model.

"A taste of freedom can make you unemployable."

True financial freedom is a disgust and downright refusal to be an employee again.

That’s how I feel. There’s just no way I’d go back to a cubicle and kiss my boss’s hairy butt over back-to-back lattes at the local office worker cafe.

I didn’t always think like this. Then I started pulling $70,000 months online and went to myself “Hey, like, why would I work a job anymore?”

I didn’t quit and light the place on fire or anything. But I did go out in a blaze of glory with one sale that 12X’d my revenue KPI. Something to prove Timbo? Yes.

Once I learned to work from home without emails, meetings, and working with BS employees that were about as smart as a brick wall, it changed the game.

You can undo the programming. Life is transformed forever.

The goal in life should be to taste financial freedom – or at least get some level of passive income – so you can see traditional work for what it is.

"Trade money for time, not time for money. You’re going to run out of time first."

Let’s bring this whole Naval money philosophy together.

Trading time for money is bad. Wealthy people have an abundance of time. Poor people trade time for money. Rich people trade money for useless status.

The real billionaires don’t have billions of dollars. No. They are time billionaires with an abundance of time.

Take Warren Buffett for example. The guy doesn’t want more money.

What he wants is to trade his fortune to be a 20 year old again and have the sex drive of a horny monkey at the zoo. But money can’t buy old mate Warren this dream. His money is more useless by the day.

The takeaway here is to value time over money.

Use money to buy back your time any way you can. And use money to make money to buy more time. That’s how you become financially free.

P.S.

One of the best secrets to financial freedom is simply…

having better ideas than most.

That’s the topic of my free masterclass next week.

Grab a spot at the link below (there’s a limit)

In our opinion, this is you best piece yet. Great work!

Great read, Naval is someone to study for anyone who wants to build wealth. Thanks Tim!